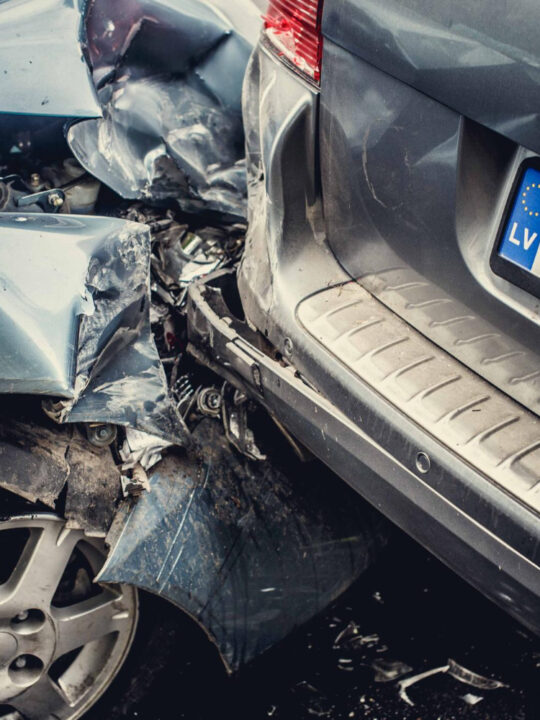

Car insurance provides security and safety to your health and physical property by hedging risk. Car insurance covers financial loss by insured your property from the insurer against the premium paid by you to the insurance company. If you buy a car insurance policy then you drive on the road with safety. It allows us to drive slow and safe. It is suitable because it covers the risk of property from accident, a natural disaster like (flood, hurricane, explosion, etc.), theft, striking, keying, and much another risk to your property.

Car insurance provides security and safety to your health and physical property by hedging risk. Car insurance covers financial loss by insured your property from the insurer against the premium paid by you to the insurance company. If you buy a car insurance policy then you drive on the road with safety. It allows us to drive slow and safe. It is suitable because it covers the risk of property from accident, a natural disaster like (flood, hurricane, explosion, etc.), theft, striking, keying, and much another risk to your property.

Table of Contents

Factors to be considered while taking car insurance policy

Various companies are providing various types of car insurance policies offering different benefits. An effective car insurance policy covers a good amount of loss and provides more benefits to you. You have to take the right policy from the right buyer. There are many factors which must be studied before taking policy .you have to research allot while taking the policy. There are many companies which provide additional benefits to the persons. Therefore you don’t need to make a hurried decision which affects your future. Some of these factors are given below:-

1. Value to be insured

First and most important factor is the insured value which you have to study before taking the policy. The insured value means the total amount of policy that a purchaser of policy has to pay to the insurance company. Insured value should be affordable to the purchaser. One has to take the policy which has insured value equal to the value of the property so that it covers the loss properly. If the insured value is low then you receive fewer claims at the time of uncertainty.

2. Premium value

Another factor is the consideration you have to pay against your policy. Premium determine the claim value like if the premium is low then the insured value is less or vice-verse. Premium is a regular expense for the person who takes the policy.

3. Kinds of policies

There are various types of policies offered by the company like comprehensive policy, basic policy, rental policy, full coverage policy, etc. Every policy offers different benefits to the company, person, and UBER drivers who offer their car facility to the people on a rent basis. While taking policy you have to study the classification and which classification and kind are best. Like comprehensive cover all risk, if your vehicles are prone to have a risk of theft, keying, and natural calamities then it is the most suitable policy for you.

4. Additional features

Some car insurance companies are not only providing one benefits of covering loss but provides some add-on features to the policyholders like financial assistance and additional information regarding safe driving, teaching and learning process of traffic rules, car insurance for UBER drivers because UBER require compulsory car insurance for drivers.

5. The reputation of the company

This is a very important factor because your loss is covered by the company if companies’ net worth is not so good then they not only fail to pay the claim but also failed in offering additional benefits.

6. Remaining claim in cash

Some companies offer deductible car insurance under which if an accident occurs company pays for damages and remaining claim value if any in cash form.

About the author:

Tejas Maheta is the Founder of top10ratelist.com and a tech geek. Besides blogging he love reading books, Learning new things, and Hanging out with friends.